beta calculation in excel: Excel Tutorial: How to use Checkbox Toggle and save time

Contents:

The Fund’s beta of more than 1 indicates that the fund is highly volatile and is more responsive to market movements. When the beta is less than one, the fund is said to be less volatile to the market scenarios. Alpha value of 2.75 indicates the fund’s outperformance. Though beta provides insight into an asset’s relative riskiness. It does not provide insight into the asset’s inherent or absolute risk. To compute the real risk-free return, you should subtract the inflation rate from the 10-year government bond yield.

Every investment has a certain amount of risk attached to it. Practically, there are no investment schemes that are 100% risk-free. However, the yield of treasury bonds is considered a standard risk-free rate. The risk-free rate in India is the 10-year government bond yield rate. Stock A has the potential to earn 10% more than the expected return, but is equally likely to earn 10% less than the expected return. A positive alpha is the extra return would be awarded to you for taking a risk, instead of accepting the market return.

Understanding Excel’s MMULT function to solve for Portfolio Variance:

If the security or beta calculation in excel does not meet or exceed the required return, then the investment should not be entered into” (pg. 91). It means that, if Stock A is riskier than Stock B, the price of Stock A should be lower to compensate investors for taking on the increased risk. Please note that this is a simplistic formula for beta for the purpose of your understanding. Beta is calculated in Excel using Regression tool in the Data tab. You may need to install data analysis pack in Excel unless it is already installed. The investors use this assessment to check if the required rate of return has an increase in value and if there is a presence of any inherent risk level of the asset.

It also helps produce substantial data to reckon its prospects in the future – growth potential, sustainability, risk factor, etc. In case of beta, value 1 suggests that a specific fund responds to market volatility equivalently, i.e. the shift in its price is equivalent to the benchmark movements. A value above 1 represents that a specific fund demonstrates a more significant shift in its price compared to benchmark movement. Valuation spreadsheet has few charts that show averages for past as well as projected ROE and growth rates. Model assumes that a business growing at a high growth rate has higher risks than a business that is slowing down or has reached a mature phase.

share page

We offer skill certifications for job roles ranging from accounting, finance, derivatives, bond markets, Risk, financial modelling etc. What you need to take out of this is that the fund with the lower standard deviation would be more optimal because it is maximizing the return received, for risk acquired. The standard deviation of a set of data measures how “spread out” the data set is. In other words, it tells you whether all the data items bunch around close to the mean or if they are “all over the place.”

How Do You Calculate R-Squared in Excel? – Investopedia

How Do You Calculate R-Squared in Excel?.

Posted: Sat, 25 Mar 2017 18:47:51 GMT [source]

Stocks that deviate greater than the market value over a size of time will have betas of above 1.zero. Calculating beta finance just isn’t too troublesome and can be accomplished with a spreadsheet program and some market data. If a stock deviates less than the market does, the stock will have a beta of less than 1.0.

Limitations of Beta

A single click on the sheet and the whole data series is added/deleted. The concept encapsulated my thoughts for a while and I present a small and simple tutorial on the same. Try opening the older version (.xls version) and enable macros. You can delete that you can still use rest of the spreadsheet. Elaborating on the discussion, if we assume that the Rs 500 is infused as pure equity and no debt is taken.

Company’s profitability should drop as the company moves from high growth phase to mature phase. Another way of looking at DDM vs FCF issue is to look at the practical meaning of the cashflow to be used in a DCF. CF in a DCF is the amount of money that can be hypothetically taken out of the business without affecting the growth of the business. Dividends is the actual money that is being taken out of the business without affecting the growth of the business. A third model called Capital Asset Pricing Model is used to arrive at intrinsic value based on short term projections that are interpolated from longer term projections. Additionally, residual income model is used to calculate present value of economic value added as a way to cross check DDM valuation.

Using the value of beta, you can determine whether or not to include the fund in your investment portfolio. Risk-averse investors should prefer funds with a beta less than 1, while risk-takers can opt for funds with a higher beta. For investors, alpha is a valuable metric for deciding if a mutual fund is worth investing in because it gauges the fund manager’s ability to make profits. As a result, you can make an informed investment decision based on the fund manager’s performance.

How to Calculate Beta for a Stock & for Your Portfolio • Benzinga – Benzinga

How to Calculate Beta for a Stock & for Your Portfolio • Benzinga.

Posted: Tue, 02 Aug 2022 07:00:00 GMT [source]

In this chapter, we will talk about measuring the risk and return of a portfolio of securities. To do so, select all the cells that contain the returns data, including the row that contains stock names. Beta is used within the Capital Asset Price Model, which measures a inventory’s return. The CAPM calculates the required return of an asset versus its threat.

Add to Portfolio

It is a 100% practical program with dozens of case studies & practical discussions. The approach of delivering the concepts is application based to make you a right fit for your dream role in finance. Though we cover everything from very basic, but expect the candidate to have basic understanding of Time Value of Money concept and MS excel familiarity. Parth is a qualified CA and NYU Stern School of Business alumni with 5+ years of total work experience spanning across Corporate Finance, Business Valuation, and Equity Research. We will learn to prepare equity research and valuation report from scratch by using skills we learned, researching about the company, quarterly con calls, analysing annual reports, etc. We will learn financial models using international FAST standards.

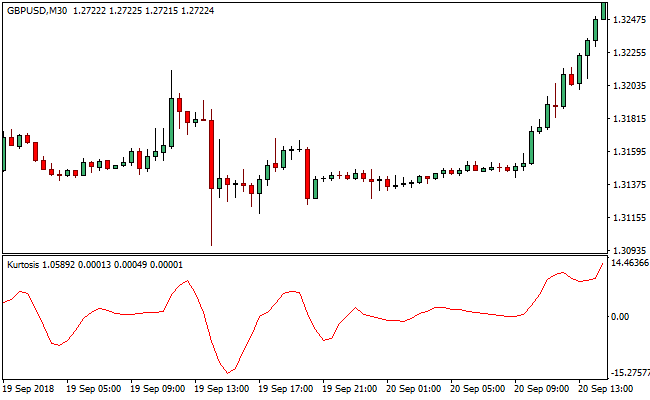

Beta is a measure of the volatility of a inventory’s returns relative to the fairness returns of the overall market. It is used to measure the variation of a set of data from the mean or average. In the case of Mutual Funds, the standard deviation indicates the digression of Mutual Fund returns in different phases of the market from the average or mean as calculated prior.

- When calculating beta in Mutual Funds, there are two key components – covariance and variance.

- Elaborating on the discussion, if we assume that the Rs 500 is infused as pure equity and no debt is taken.

- However, there is no tool available where all these techniques and guidelines can be put together to calculate intrinsic value and expected returns.

- What you need to take out of this is that the fund with the lower standard deviation would be more optimal because it is maximizing the return received, for risk acquired.

- Let us understand this using a simple, hypothetical example of two stocks.

- It was first used and developed by Harry Markowitz in 1952.

What is beta in mutual funds – A more useful understanding of risk is in relation to the market or rather the relevant market benchmark. Beta of a mutual fund scheme is the volatility of the scheme relative to its market benchmark. If beta of a scheme is more than 1, then scheme is more volatile than its benchmark. If beta is less than 1, then the scheme is less volatile than the benchmark. If a scheme outperformed its benchmark you should try to understand, whether the beta of the scheme was high or the fund manager was able to deliver superior risk adjusted returns.

Before proceeding towards discussing https://1investing.in/ risk and return, let us first understand how to calculate the expected return on a security. The danger of an funding can’t be measured irrespective of return. Calculating beta requires the danger-free fee, inventory’s rate of return, and market rate of return. Beta coefficient is an important enter within the capital asset pricing model .